The Pakistan Stock Exchange (PSX) has been a focal point of investor attention, with fluctuations in its performance closely monitored by market participants and analysts alike. However, recent trends have shown that the PSX has struggled to maintain its upward momentum, failing to sustain above the significant benchmark of 75,000 points. Profit-selling pressure has emerged as a key factor, dampening investor sentiment and contributing to the market’s volatility.

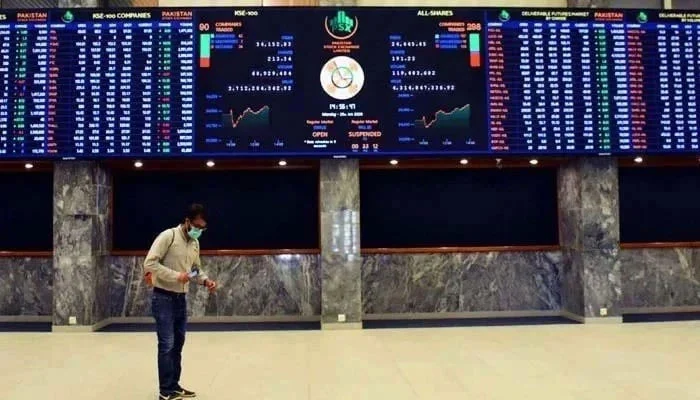

Market Overview: The PSX serves as the premier stock exchange in Pakistan, facilitating the trading of equities, bonds, and derivatives. It plays a pivotal role in the country’s financial ecosystem, serving as a barometer of economic health and investor confidence. Over the years, the PSX has witnessed periods of bullish and bearish trends, reflecting both domestic and international economic dynamics.

Recent Performance: In recent months, the PSX experienced a notable rally, with the benchmark KSE-100 index breaching the 75,000-point mark—a significant milestone for the market. However, this upward trajectory proved to be short-lived, as profit-selling activities began to exert downward pressure on stock prices. Despite initial optimism, the PSX struggled to sustain its gains, leading to a reversal in sentiment among investors.

Factors Contributing to Decline: Several factors have contributed to the PSX’s failure to sustain above 75,000 points, including:

- Profit-Selling: Investors resorting to profit-selling to capitalize on gains, leading to downward pressure on stock prices.

- Economic Uncertainty: Uncertainty surrounding the domestic and global economic outlook, including concerns about inflation, interest rates, and geopolitical tensions.

- Corporate Earnings: Disappointing corporate earnings reports from key sectors, dampening investor confidence in the market’s growth prospects.

- Foreign Selling: Increased selling pressure from foreign investors, driven by concerns about emerging market risks and currency depreciation.

Impact on Investor Sentiment: The inability of the PSX to sustain above 75,000 points has had a noticeable impact on investor sentiment. Many investors who had entered the market during the bullish phase are now facing losses or reduced profits, leading to a cautious approach towards further investment. This shift in sentiment has contributed to increased volatility in the market, as investors react to changing economic and geopolitical developments.

Market Volatility and Risk Management: The recent volatility in the PSX underscores the importance of effective risk management strategies for investors. Volatile markets can expose investors to heightened risks, including the potential for capital losses and increased uncertainty. Implementing risk management techniques such as diversification, stop-loss orders, and hedging can help investors mitigate the impact of market fluctuations on their investment portfolios.

Regulatory Measures: In response to the market’s volatility, regulatory authorities have taken steps to enhance oversight and improve transparency in the PSX. Measures such as increased surveillance, stricter enforcement of compliance standards, and enhanced disclosure requirements aim to promote investor confidence and ensure the integrity of the market. Additionally, regulatory bodies are working to streamline processes and introduce reforms that foster a more robust and resilient market infrastructure.

Investor Education and Awareness: Amidst market fluctuations, investor education and awareness play a crucial role in empowering market participants to make informed decisions. Educating investors about market dynamics, risk management strategies, and investment principles can help them navigate volatile market conditions with confidence. Furthermore, promoting financial literacy initiatives and providing access to resources and tools can empower investors to take control of their financial future.

Long-Term Outlook: Despite the current challenges facing the PSX, many analysts remain optimistic about the market’s long-term prospects. Pakistan’s growing economy, young demographic profile, and strategic geographic location position it as an attractive destination for investment. Additionally, ongoing infrastructure development initiatives, such as the China-Pakistan Economic Corridor (CPEC), present opportunities for economic growth and investment in the country.

The Pakistan Stock Exchange’s failure to sustain above 75,000 points reflects the impact of profit-selling pressure and market volatility on investor sentiment. While short-term fluctuations may dampen market confidence, long-term fundamentals remain favorable, offering opportunities for growth and investment in Pakistan’s economy. By implementing effective risk management strategies, enhancing regulatory oversight, and promoting investor education, stakeholders can navigate the challenges of a dynamic market environment and position themselves for success in the long run.